vanmeetin.ru Tools

Tools

Investors Buying Farmland

Two prominent platforms, AcreTrader and FarmTogether, both allow individuals to invest in farmland with as little as $15, These platforms pool investors'. The burgeoning interest of investment firms in farmland underscores its attractiveness as a resilient investment product during periods of high inflation, hedge. Generally, farmers are purchasing about 70 percent of land sold by Schrader Real Estate and Auction Co., while investors buy 30 percent, said R.D. Schrader. Farmland real estate, as an investment class, is much easier to research and understand than any stock or other kind of financial investment vehicle. Approaching Farmland as an Investor Historically, investors gained access to farmland as an investment category by simply buying farms. And many investors—. We invest in irrigation and water rights, fencing, large farm equipment, value-add facilities, and other assets. Selling crops is the primary source of income for most farmland investments. The type and quantity of crops grown will determine your potential earnings. Investing in farmland isn't just about purchasing a plot of land. It's about securing an asset with strong growth potential, stable returns and low volatility. You know how people are worried about foreign investors buying up US farmland? There's a company that helps them do that! It's like Uber for. Two prominent platforms, AcreTrader and FarmTogether, both allow individuals to invest in farmland with as little as $15, These platforms pool investors'. The burgeoning interest of investment firms in farmland underscores its attractiveness as a resilient investment product during periods of high inflation, hedge. Generally, farmers are purchasing about 70 percent of land sold by Schrader Real Estate and Auction Co., while investors buy 30 percent, said R.D. Schrader. Farmland real estate, as an investment class, is much easier to research and understand than any stock or other kind of financial investment vehicle. Approaching Farmland as an Investor Historically, investors gained access to farmland as an investment category by simply buying farms. And many investors—. We invest in irrigation and water rights, fencing, large farm equipment, value-add facilities, and other assets. Selling crops is the primary source of income for most farmland investments. The type and quantity of crops grown will determine your potential earnings. Investing in farmland isn't just about purchasing a plot of land. It's about securing an asset with strong growth potential, stable returns and low volatility. You know how people are worried about foreign investors buying up US farmland? There's a company that helps them do that! It's like Uber for.

AcreTrader is the farmland real estate investment company offering low minimum, passive farm investments. Invest online and we will handle all of the. Billionaire Investors Are Buying Farmland ( Dec. 19, AM ETBRK.A, BRK. AM ETBRK.A, BRK.B, BTC-USD VNQ, XLU66 Comments 9 Likes. Since , our farmland expertise has helped both individual and institutional clients purchase, acquire and sell farm real estate across Indiana and Illinois. An Organic Farmland Real Estate Investment Trust · More videos on YouTube · We work with mission-driven investors to provide organic and regenerative farmers land. This guide will break down why investors are choosing to buy farmland as well as the growing number of ways to add this asset class to a portfolio. Approximately twenty-four states have laws that seek to restrict to some degree foreign ownership or investments in private agricultural land within the. Farmland Can Help Decrease Volatility. Studies reveal that adding farmland to a portfolio consisting of only stocks and bonds both increases the portfolio's. Profitability and capital appreciation that is created by the partnership through long-term financial investors. Buy land, infrastructure, machinery and. FAVORABLE FARMLAND INVESTMENT FACTS Diversification – farmland is not correlated to stocks and bonds. Historically farmland has had less volatility than. Nowadays, farmland is a viable alternative investment generating returns through both rental yields and the appreciation of the land's value, no need to work. Direct investment into global agricultural land presents an increasingly compelling investment opportunity, as it offers potentially stable returns on. Its low-risk nature can help diversity your holdings and balance out some of your riskier stock market investments. Land can also serve as a vehicle of wealth. How can one capitalize on the increased global protein consumption and demand for food? An investment in farmland will provide a steady stream of income and. The Investors' Guide to Farmland will guide you through the rational for investment in farmland, understanding the characteristic of farmland, and why it. Understanding the intricacies involved in buying and selling farmland empowers investors to make informed decisions and thrive in any market condition. They pool investor's money to purchase assets (farmland) and then rent it out to local farmers. Their revenue model comes from capital gains, rent, and other. As farmers retire from the profession and the value of their farmland increases, so does interest among wealthy non-farmers and pension funds. Whether you purchase a farm outright or opt to invest through fractional ownership with other investors, you can feel more confident that your money will work. Our Exchange Program enables investors to either swap one investment property with farmland—a like-kind replacement property—or invest in a real property. Warren Buffett liked the simplicity of farmland, its defensiveness, its diversification benefits, and its reward prospects.

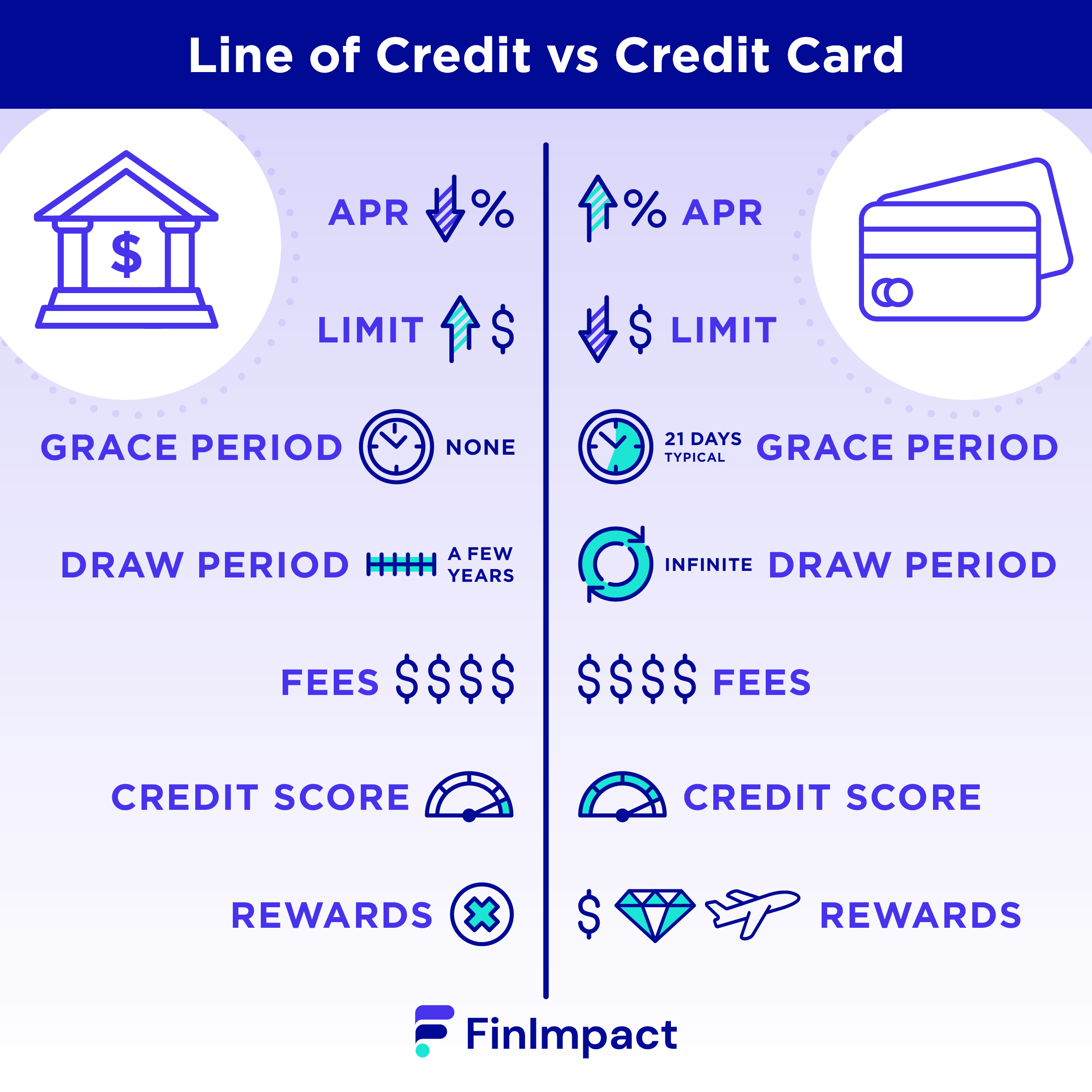

Line Of Credit Card

Wells Fargo Business Lines of Credit provide access to funding to manage cash-flow, expenses or business expansion. Unsecured and secured options available. Like a Credit Card, only better. A VeraBank line of credit option offers you the ability to use a line that you can pay down & use again when you need it. A personal line of credit works sort of like a credit card. The lender gives you a credit limit, and every time you borrow, you use up some of your credit line. A credit line is a flexible loan that allows you to borrow as needed up to a certain limit. Just like a credit card, you don't need to take the whole amount. Line of Credit · Borrow as little as $ up to $5, · Low monthly payment · Overdraft protection option available · Access credit by debit card, digital banking. We think these loan options might be right for you. · Home Improvement Loan · Credit Card Consolidation Loan · Unsecured Personal Loan · Auto Loan · Home Equity Line. Line of Credit · Borrow as little as $ up to $5, · Low monthly payment · Overdraft protection option available · Access credit by debit card, digital banking. A line of credit (LOC) is a preset borrowing limit offered by banks and financial institutions to their personal and business customers. A revolving credit line allowing you to borrow as much as you need up to your limit and only pay interest on your total balance. Wells Fargo Business Lines of Credit provide access to funding to manage cash-flow, expenses or business expansion. Unsecured and secured options available. Like a Credit Card, only better. A VeraBank line of credit option offers you the ability to use a line that you can pay down & use again when you need it. A personal line of credit works sort of like a credit card. The lender gives you a credit limit, and every time you borrow, you use up some of your credit line. A credit line is a flexible loan that allows you to borrow as needed up to a certain limit. Just like a credit card, you don't need to take the whole amount. Line of Credit · Borrow as little as $ up to $5, · Low monthly payment · Overdraft protection option available · Access credit by debit card, digital banking. We think these loan options might be right for you. · Home Improvement Loan · Credit Card Consolidation Loan · Unsecured Personal Loan · Auto Loan · Home Equity Line. Line of Credit · Borrow as little as $ up to $5, · Low monthly payment · Overdraft protection option available · Access credit by debit card, digital banking. A line of credit (LOC) is a preset borrowing limit offered by banks and financial institutions to their personal and business customers. A revolving credit line allowing you to borrow as much as you need up to your limit and only pay interest on your total balance.

It is usually accessed through a separate account linked directly to the line of credit. This account acts like a credit card or a separate checking account. As you repay your outstanding balance, the amount of available credit is replenished – much like a credit card. This means you can borrow against it again if. A personal line of credit is a set amount of funds that you can withdraw as needed. If you need ongoing access to funds, or if you don't know the full cost of a. A personal line of credit works sort of like a credit card. The lender gives you a credit limit, and every time you borrow, you use up some of your credit line. A personal line of credit gives you instant access to your available credit, as you need it. It doesn't require a specific purchase purpose and carries a. With a line of credit, you can borrow against the limit and make repayments as needed within the account's terms and conditions. To access a personal line of. However, it is a form of revolving credit — just like a credit card. With a PLOC, you have a credit limit and you can spend up to that specified amount. But as. We offer a number of secured and unsecured personal lines of credit that can help you gain flexible access to cash and serve as optional overdraft protection. A HELOC is a credit line, like a credit card would offer, that uses the equity in your home as collateral! It lets you borrow funds as needed, up to a set. Unlike a loan, a business line of credit allows you to use funds only when you need them, and you are only required to make periodic payments on the amount that. With a line of credit, you can borrow against the limit and make repayments as needed within the account's terms and conditions. To access a personal line of. A line of credit is a revolving loan that allows you to access money as you need it up to a certain limit. You can borrow up to that limit again as the money is. Apply by phone at Monday – Friday from 6 am to 7 pm, Saturday 8 am to 2 pm. Non-customers cannot apply online for personal lines of credit at. It's bad in the eyes of a bank and lenders to have a lot of credit card accounts open, even if they're paid every month. LINE OF CREDIT LOANS. Flexible Credit for Your Personal Needs. apply now These statements are similar to credit card statements, they outline your. With credit cards, there's a specific payment cycle—with a line of credit, the money is available upfront for you to use during a set time period (or draw. A credit line on a credit card is the maximum amount a credit card user can charge to the account, including purchases, balance transfers, cash advances, fees. Truist's unsecured personal line of credit allows for easy access to funds to help cover financial gaps & expenses. Credit lines start at $ All loans, lines of credit and PNC Bank credit cards are subject to credit approval. Requires automatic deduction from your PNC business checking account. The Pitney Bowes Bank Line of Credit allows you to preserve your cash flow—and your business credit card—by providing one, secure line of credit.

Do You Have To Have Money To Refinance Your Home

Many homeowners use cash-out refinances to get the funds they need for a down payment on a new property or buy a new home in cash if they have enough equity. Refinancing is the process of paying off an existing mortgage loan with a new one. Generally speaking, if refinancing can save you money, help you build. Before you decide whether or not to refinance your mortgage, make sure that you have adequate home equity. At least 20% equity will make it easier to qualify. Answering this question will help you determine if refinancing will even make sense financially. Why? Like your original mortgage, refinancing will require an. A cash-out refinance will generally reduce or eliminate the home equity you've built over time. Keep in mind that home equity is a highly valuable asset that. The most common type of refinance is a no cash-out refinance, in which you are refinancing the remaining balance on your mortgage to a different mortgage rate. The cost to refinance a mortgage ranges from 2% to 6% of your loan amount, and you can expect to pay less to close on a refinance than on a comparable purchase. A cash-out refinance allows you to use the equity in your home to fund home renovations, pay off your debt or finance another large expense. · It could be a. Yes, it's possible to get a cash-out refinance on a paid-off home. It's still called a refinance even though you won't be paying off an existing mortgage. Many homeowners use cash-out refinances to get the funds they need for a down payment on a new property or buy a new home in cash if they have enough equity. Refinancing is the process of paying off an existing mortgage loan with a new one. Generally speaking, if refinancing can save you money, help you build. Before you decide whether or not to refinance your mortgage, make sure that you have adequate home equity. At least 20% equity will make it easier to qualify. Answering this question will help you determine if refinancing will even make sense financially. Why? Like your original mortgage, refinancing will require an. A cash-out refinance will generally reduce or eliminate the home equity you've built over time. Keep in mind that home equity is a highly valuable asset that. The most common type of refinance is a no cash-out refinance, in which you are refinancing the remaining balance on your mortgage to a different mortgage rate. The cost to refinance a mortgage ranges from 2% to 6% of your loan amount, and you can expect to pay less to close on a refinance than on a comparable purchase. A cash-out refinance allows you to use the equity in your home to fund home renovations, pay off your debt or finance another large expense. · It could be a. Yes, it's possible to get a cash-out refinance on a paid-off home. It's still called a refinance even though you won't be paying off an existing mortgage.

This is designed to see whether you can keep up with your mortgage payments if interest rates were to increase. All federally regulated lenders must perform a. Most of the time, home owners are required to have paid off at least 20% of their mortgage before attempting to refinance. Plus, paying off your current. With cash-out refinancing, you can take advantage of the equity in your home to access money you can use today for your personal financial goals. You. Can refinancing your current mortgage save you money? Check out this video with our Mortgage Specialist, Wayne Short. FAQs. Q. When should I refinance my. You can refinance with an FHA loan even if you have little equity in your home. In fact, the FHA refinance process is streamlined. If you're struggling to make your payments every month or just need some breathing room, refinancing to get a lower monthly payment could be a smart idea. If. If you have available equity in your home, you may be able to get cash at closing with a cash-out refinance loan. Explore cash-out refinance loans. Often homeowners refinance to try to lower the cost of their mortgage. For example, you might be able to get a new mortgage with a lower interest. FHA cash out refinances have a seasoning period of 12 months from the initial purchase. To qualify for FHA refinancing, you need to be current on your mortgage. Home equity is built through mortgage payments, increases in home values or a combination of both. As a borrower, you can do a cash-out refinance to access the. The more money you put into your home, the easier it will be to refinance, regardless of when you do it. Ideally, you should pay at least 20% of the home's. Expect to pay % to % of the loan amount. If the mortgage is $,, that means you should expect to pay between $1, and $3, in loan origination. Key takeaways · Refinancing could lower your interest rate, change your loan type, adjust your loan repayment term, or cash out available equity. · You may need 5. Like your original mortgage, refinancing requires lender approval and has costs associated with the application and closing processes. Own Home Mortgage. This is essentially when the refinancing costs are “recouped” via the lower monthly mortgage payment. Cash-Out Refinance. In a cash-out refinance, you can. Cash-out refinances generally have a slightly higher mortgage rate because you are borrowing more money, which is an added risk to the lender making the loan. Title insurance fee: Ranging from $ to $, both the homeowner and lender most likely will need to have title insurance to cover any errors or problems that. To Tap Into Home Equity Homeowners with a sizable amount of equity can convert it to cash with a cash-out refinance. It's a type of mortgage that replaces. How much equity you have in your home – the more the better. · Your credit score – higher scores can get lower interest rates · Your debt-to-income ratio – how. This new loan pays off the remainder of your existing mortgage, and then you become responsible for paying off your new loan. As with your existing mortgage.

Where To Sell Your Stuff Online

OLX and Quikr are two famous platforms to sell used items online. I personally sold my OLD phone and Bike on OLX. It is Free and Easy to use. Ebid is an online marketplace where you can auction new and used goods. Although Ebid is similar to and cheaper than Ebay, it doesn't have the same reach. Our 5-Star Resellas will sell things for you on sites like eBay, Craigslist, Facebook, OfferUp and Poshmark. Here's how it works. If your “get rid of” items are starting to pile up, here are three websites where you could sell your stuff today. Ebay. This is where I sell big-ticket items that can ship. After all these years, it's still the best not-just-local option. Research various platforms where you can list items for free. Consider the nature of your products and your target audience. For general items, platforms like. eBay is the best place to start selling online! Millions of shoppers want to buy your new or used items, and it's easy to sell online and make money. If you have tech items, CDs, DVDs, video games or books to get rid of, and you want cold, hard cash, Decluttr might be right for you. The site offers next-day. Our Top 10 Best Sites to Sell Stuff Online: · eBay - best site to sell stuff online overall · Craigslist - best for no-fee local transactions · Amazon - best. OLX and Quikr are two famous platforms to sell used items online. I personally sold my OLD phone and Bike on OLX. It is Free and Easy to use. Ebid is an online marketplace where you can auction new and used goods. Although Ebid is similar to and cheaper than Ebay, it doesn't have the same reach. Our 5-Star Resellas will sell things for you on sites like eBay, Craigslist, Facebook, OfferUp and Poshmark. Here's how it works. If your “get rid of” items are starting to pile up, here are three websites where you could sell your stuff today. Ebay. This is where I sell big-ticket items that can ship. After all these years, it's still the best not-just-local option. Research various platforms where you can list items for free. Consider the nature of your products and your target audience. For general items, platforms like. eBay is the best place to start selling online! Millions of shoppers want to buy your new or used items, and it's easy to sell online and make money. If you have tech items, CDs, DVDs, video games or books to get rid of, and you want cold, hard cash, Decluttr might be right for you. The site offers next-day. Our Top 10 Best Sites to Sell Stuff Online: · eBay - best site to sell stuff online overall · Craigslist - best for no-fee local transactions · Amazon - best.

We've got all the best tips on how to sell your stuff online and in-store. Cash in your pocket while decluttering? Yes, please! eBay would be the best pick if you have hard-to-find collectibles in your stash you would like to get rid of. The first step to selling your items on eBay is. Learn how to build or grow your Etsy shop. Need help or training to get your products selling on Etsy? Visit us to find lots of resources that will get you. In short, if you're starting with just a single marketplace, Amazon is probably your best bet. [Start selling on Amazon] · 2. eBay (Worldwide | All Product. Online platforms like eBay, Facebook Marketplace, and Craigslist provide convenient ways to sell used items. Cash In and Sell Online With WeBuyBooks Trade in your old stuff with WeBuyBooks. We like to save you from any faff and fuss. Simply type in the ISBN numbers. Best Places To Sell Items Online · Facebook Marketplace · eBay · Online Classified Ads · Craigslist · NextDoor. Marketplace makes it easy to sell things to people in your local area. Here's more information about selling on Marketplace. Instantly connect with local buyers and sellers on OfferUp! Buy and sell everything from cars and trucks, electronics, furniture, and more. Looking to make quick cash or just to declutter? Sell your stuff with Decluttr today - we accept phones, CDs, DVDs, games, books, tablets and much more! Online Consignment Shops Turn Cloth Into Cash · Sotheby's Home. · ComicConnect. · ThredUp. · Poshmark. · CarGurus. · Peddle. · Gazelle. · Decluttr. Craigslist is a longstanding online marketplace that connects people locally to buy, sell, and exchange goods and services. From electronics to children's toys. The Amazon Seller app makes online selling a truly hassle-free process. The app brings your business to your fingertips, and lets you run it from anywhere. We've put together a comprehensive guide that highlights some of the best online-selling sites for various product categories and business models. 1. Find items to sell · 2. Check if there's a market · 3. Decide where you want to sell · 4. Build your item profile · 5. Publish · 6. Follow up on inquiries · 7. OfferUp - Buy. Sell. Letgo. 4+ · The largest mobile marketplace · OfferUp Inc. · iPhone Screenshots · Additional Screenshots · Description · What's New · Ratings and. It's easy to sell online with vanmeetin.ru Partner with the largest multi-channel retailer and put your products in front of millions of Walmart shoppers. You can make a lot of money selling on Flipkart if your product is right and well priced for the Indian market. While listing products is free on Flipkart, you'. Instantly connect with local buyers and sellers on OfferUp! Buy and sell everything from cars and trucks, electronics, furniture, and more.

Where Can I Find My Tax Id Number Online

Where do I get my federal employer tax ID ("EIN") number? A2. The Internal Revenue Service ("IRS") issues Employer Identification Numbers ("EIN"'s). Number," or "Tax I.D. Number", all refer to the nine Our company is exempt from taxes on purchases; therefore you should not need my TIN/EIN number. The only way to obtain your Tax ID number is from your accountant or from/on certain documentation you have for your business such as your tax return, SS4. tax registration form on the District's online tax portal, vanmeetin.ru: Your Federal Employer Identification Number and/or Social Security Number; Your. Here are some ways that you can obtain your EIN: Use the IRS EIN Assistant: The IRS EIN Assistant is an online tool that allows you to retrieve your EIN. On the Home page, under Searches, click on Sales Tax ID's. Read the instructions and tips carefully. Click Next. Enter the sales tax number(s) for verification. You can apply for a FEIN online or download the form through the IRS' website, or can call them at The Federal Employer Identification Number (FEIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating. EDGAR is an online database that is free for anyone to use. Search for a company in the database, then click on the filing link. The EIN typically appears in. Where do I get my federal employer tax ID ("EIN") number? A2. The Internal Revenue Service ("IRS") issues Employer Identification Numbers ("EIN"'s). Number," or "Tax I.D. Number", all refer to the nine Our company is exempt from taxes on purchases; therefore you should not need my TIN/EIN number. The only way to obtain your Tax ID number is from your accountant or from/on certain documentation you have for your business such as your tax return, SS4. tax registration form on the District's online tax portal, vanmeetin.ru: Your Federal Employer Identification Number and/or Social Security Number; Your. Here are some ways that you can obtain your EIN: Use the IRS EIN Assistant: The IRS EIN Assistant is an online tool that allows you to retrieve your EIN. On the Home page, under Searches, click on Sales Tax ID's. Read the instructions and tips carefully. Click Next. Enter the sales tax number(s) for verification. You can apply for a FEIN online or download the form through the IRS' website, or can call them at The Federal Employer Identification Number (FEIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating. EDGAR is an online database that is free for anyone to use. Search for a company in the database, then click on the filing link. The EIN typically appears in.

Tax numbers can be easily applied for online via the IRS website here: Apply for an EIN Tax ID Number and you'll receive the number instantly. Tip: One. Get a 9-digit employer identification number (EIN) to open a bank account, hire employees, and bolster your business's liability protection. To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. The Form W-7 requires documentation. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at The hours of operation are a.m. - p.m. local time. The best place to look your employer's EIN (Employer Identification Number) or Tax ID is in Box b of your W-2 form. Look for a 9-digit number. The only way to obtain your Tax ID number is from your accountant or from/on certain documentation you have for your business such as your tax return, SS4. How do I apply for an ITIN or renew my ITIN? Tax numbers can be easily applied for online via the IRS website here: Apply for an EIN Tax ID Number and you'll receive the number instantly. Tip: One. taxes and service charge, to obtain an account ID number. The account ID How do I submit my online business registration application? You will be. Every business needs an employer identification number to report taxes. To request an EIN, applicants must fill out Form SS-4, available on the IRS website. The. Unfortunately, there is currently no way to check your EIN status online. Atlas calls the IRS to retrieve the EIN on behalf of both US and non-US users. Please. Search your records for paper copies of old tax returns. If you filed your taxes online, you can get copies from the company you originally used to file your. An EIN (also informally called a “federal ID number”) is obtained, free of charge, from the website of the federal Internal Revenue Service (IRS) agency. How Can I Find My TIN? · Checking your business license or permit · Reviewing your company's “About” or “Legal Information” page · Calling your bank or accountant/. Virginia Tax Personal Identification Number (PIN) · What Can You Do To Help Us Why can't I register my business online? While all new businesses are. To contact the IRS, call , or click FEIN online. There is no fee to register or obtain a Business Tax Identification Number. You may also submit. A Minnesota Tax ID Number is a seven-digit number used to report and pay Minnesota business taxes. If you need one, you can apply through Business Tax. ✓ Unemployment Tax ✓ Tire and Lead Acid Battery Fee ✓ Corporate Income Tax. You may be required to obtain a Federal Employer Identification Number (FEIN). On the Home page, under Searches, click on Sales Tax ID's. Read the instructions and tips carefully. Click Next. Enter the sales tax number(s) for verification. Before you begin - This online application is for registering businesses that do not already have a Nebraska Tax ID Number, not for adding additional tax.